- Company NameNational Tax Service

- Type of businessFiscal and Economic Policy Administration

- Sales-

- EmployeesAbout 170 people

- Introduction ServicesWeb Voice

-

Pain Point

-

Taxpayers in their 60s and older are increasing... Consideration of tax services for the elderly and the disabled, etc

Since 2018, the National Tax Service has provided an SARS service that allows taxpayers to report and pay comprehensive income tax more conveniently. Even after providing the service, various opinions were heard to improve the tax administration of the people and the improvement was reviewed. As the number of elderly people has continued to increase since entering the aging society in 2017, there was a demand for convenience services for the elderly who naturally had difficulty using smartphones as the number of young taxpayers under 50s decreased and taxpayers over 60s increased. The National Tax Service has decided to provide additional "National Tax Notice ARS Simple Inquiry" services that allow people to pay taxes over the phone to provide more convenient tax services to the elderly and the disabled.

-

Solution

-

Web Voice, Launches Self-Service

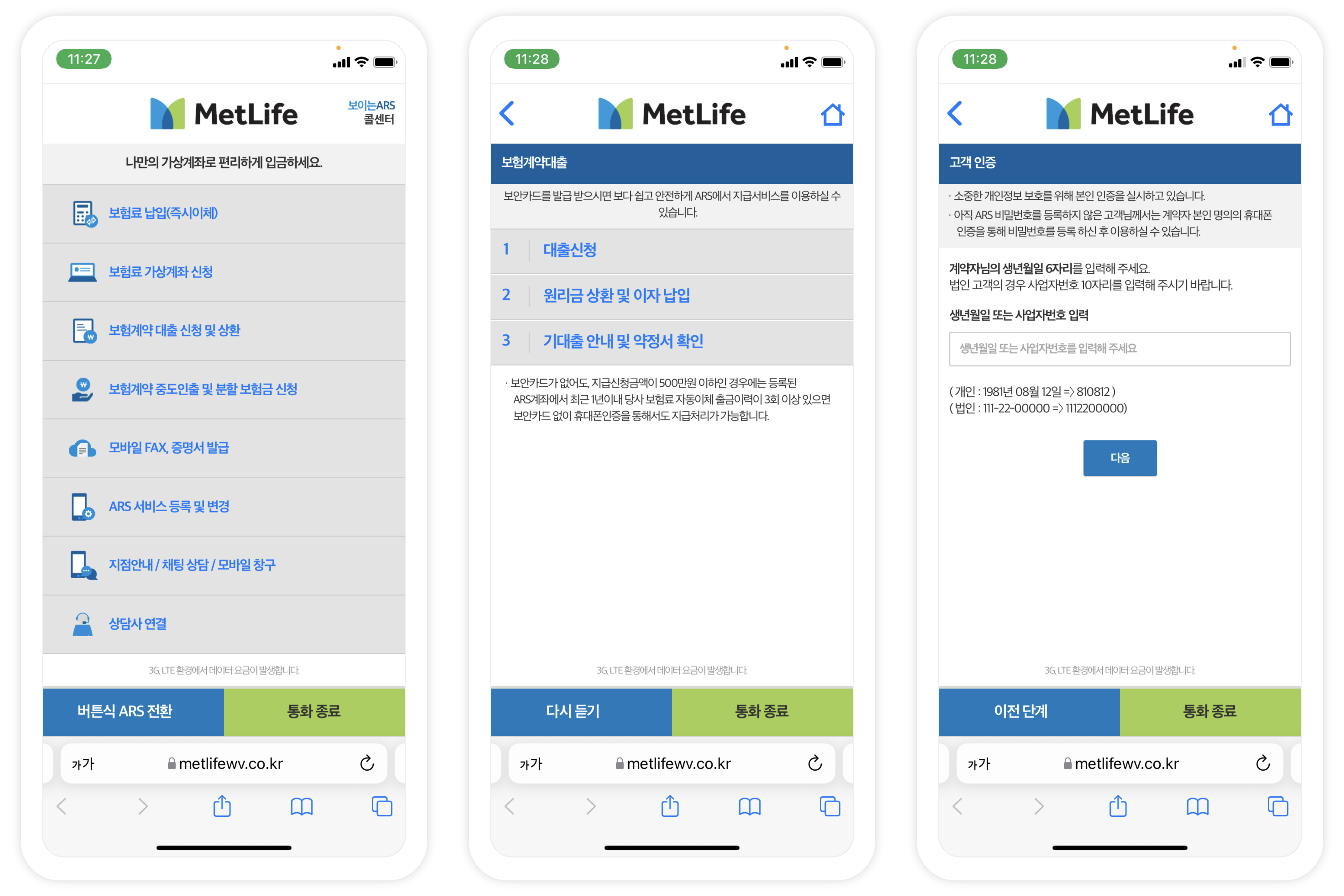

In order to reduce the dependence of counselors, Web-Voice was introduced among visible ARSs to actively guide self-service. By analyzing the customer's behavior patterns, simple but frequently inquired items such as paying insurance premiums and issuing certificates were placed on the first screen to induce customers to handle them on their own.

-

Result

-

Self-service dramatically reduces the proportion of simple inquiries!

Of the visible ARS entries, 27% began to find the items they wanted on the screen without connecting to the counselor and use them as self-service. As the number of simple inquiries decreased due to self-service, counselors became able to consult more dense with individual customers, and the number of calls leading to counselors also fell 5%, receiving positive reviews internally from MetLife.